Hold then Capture

We need to configure your account (whether you are planning to use our test keys or live keys) before your developers can start testing and integration. Kindly message [email protected] to request for key configuration. Your account's eligibility will be reviewed before you can access this feature.

What is Hold then Capture?

Hold then Capture is essentially Pre-authorization and Capture.

Credit card payments are split into two operations, namely Authorization and Capture

An authorization is the message PayMongo sends to the issuer to ask if we are authorized to pull money from the person's debit account or credit line. A capture is the actual act of pulling money from the issuer to PayMongo.

Traditionally, both are called sequentially. This means that a capture is called automatically after an authorization call. This is what is known as a straight payment or an automatic capture. We currently support this feature as the default way of capturing payments.

With this feature, the merchant can request to capture the funds separately. In this case, the authorization is done prior to when the transfer of funds is actually made. This is what's known as pre-authorization or manual capture.

Integrating through the Payment Intent Workflow

The payment intent workflow is the main workflow used to make payments via PayMongo. It's in this flow where both automatically captured payments and manually captured payments are made. By default, this workflow is set to the automatic capture of payments. To enable manual captures, a few additional steps just need to be added to the existing workflow.

1. Creating a Manual Capture Payment Intent

To create a payment intent that will be used for manual capture, the merchant can set the capture_type attribute in the payload of the payment intent to manual. When the attribute is not provided, the attribute is automatically set to automatic. Additionally, they can also do straight payments by setting the attribute to automatic.

Sample payload for manual capture payment intent:

{

"data": {

"attributes": {

"amount": 20000,

"payment_method_allowed": [

"card"

],

"payment_method_options": {

"card": {

"request_three_d_secure": "any"

}

},

"currency": "PHP",

"description": "Pre-auth trial",

"capture_type": "manual"

}

}

}

2. Attaching a Payment Method to a Payment Intent

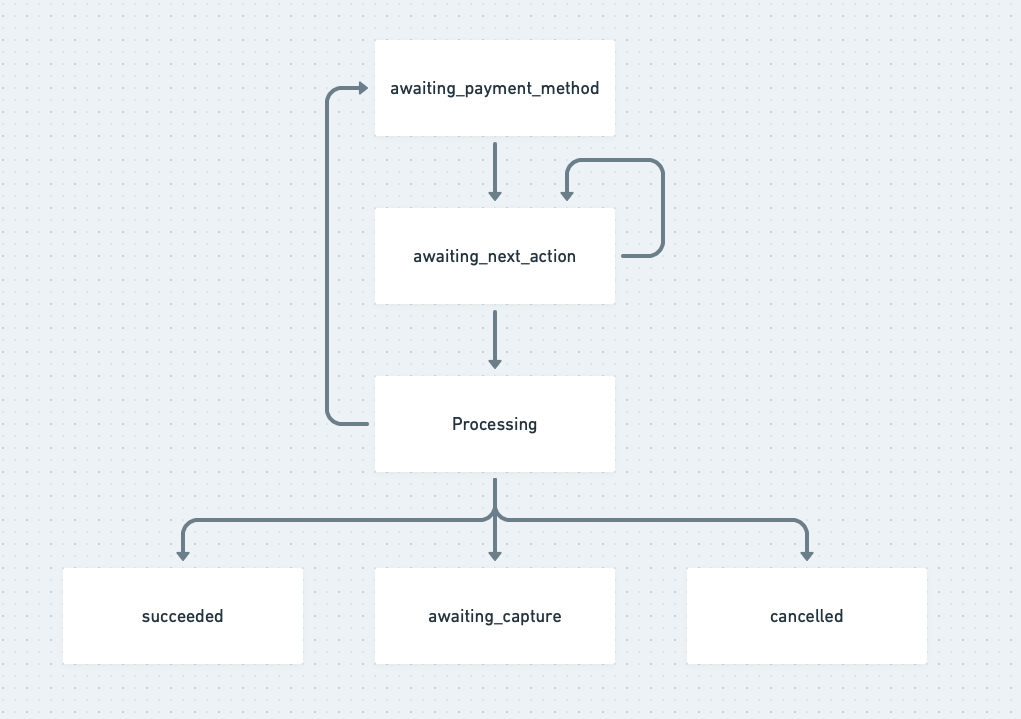

The attachment follows the same directions as normal in the PIPM workflow. After attachment, the following status flow is observed. For payment intents with the manual capture_type, after either 3DS is completed, or after attachment for non-3DS cards, the status will become awaiting_capture. It's in this status where the authorized payment intent is ready for capture.

3. Capturing a Payment

The capture API (POST /payment_intents/:id/capture) can be used to capture a payment from an awaiting_capture payment intent. Note that the merchant can only capture within 7 days from when the status was set to awaiting_capture. After 7 days, the authorization is automatically voided.

When capturing, the merchant can optionally set an amount attribute. This pertains to how much they would like to capture from an authorized payment intent. Merchants are allowed three options for this field:

- To not provide the attribute or the payload

- To set the value of the

amountequal to the payment intent amount - To set the value of the

amountas less than the amount of the payment intent

The first and second cases lead to the same result and will fully capture the authorized amount; these are called full captures. The third will only capture a portion of the authorized amount; this is called a partial capture.

On partial captures:

The remaining balance of the authorized amount after partial capture is kept on hold by the issuer for around 2-4 weeks depending on the issuer. Unfortunately, it is an industry standard to let the issuer reverse the partial amount after a few weeks. We are still currently investigating a way around this issue.

Sample payload for partial captures:

{

"data": {

"attributes": {

"amount": 10000

}

}

}

Take note that attaching a payload is an optional step. It is not required to attach the payload if it is intended to be a

full capture.

Cancelling a Payment Intent

Payment intents can be cancelled at any time as long as they aren't in the succeeded or the cancelled status. When they are cancelled while the status is awaiting_capture, we void the authorization. A merchant can void within 7 days before it is automatically voided by our system.

The payment intent status will be cancelled if it is

awaiting_captureand it is automatically cancelled by our system in 7 days. This voiding will reflect instantaneously.

Testing

For test transactions, feel free to check out the testing section of our developer documentation.

Updated over 2 years ago