E-wallets

Does PayMongo support e-wallets?

According to the Philippine central bank’s (BSP) survey, 71% of Filipinos are "unbanked". Only 29%, 31.3 million, had bank accounts in 2019. In 2020, the number of mobile wallet users in the Philippines reached 24.6 million, with forecast figures reaching as much as 75.5 million in 2025.

The Philippines has logged the highest percentage of new electronic-cash adopters in Asia Pacific amid the pandemic. The Philippines leads the region in e-wallet adopters, with 37% of respondents saying they started using digital methods during the pandemic.

With the current growth of e-wallet usage in the Philippines, a number of your customers may have different digital wallets already installed on their phones. We’re here to help bridge the payment gap and help your business accept them via e-wallet payment options. We’re currently partnered with GCash, Maya, GrabPay and Coins.ph with more to come. Through PayMongo, you can start accepting e-wallet payments with only ONE account.

Here's how your customers can pay via our different e-wallet options:

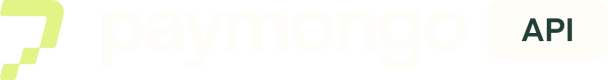

- Review and confirm the payment breakdown of your order. Then choose from any of the available e-wallet payment options on the PayMongo checkout page.

Example on PayMongo Links

-

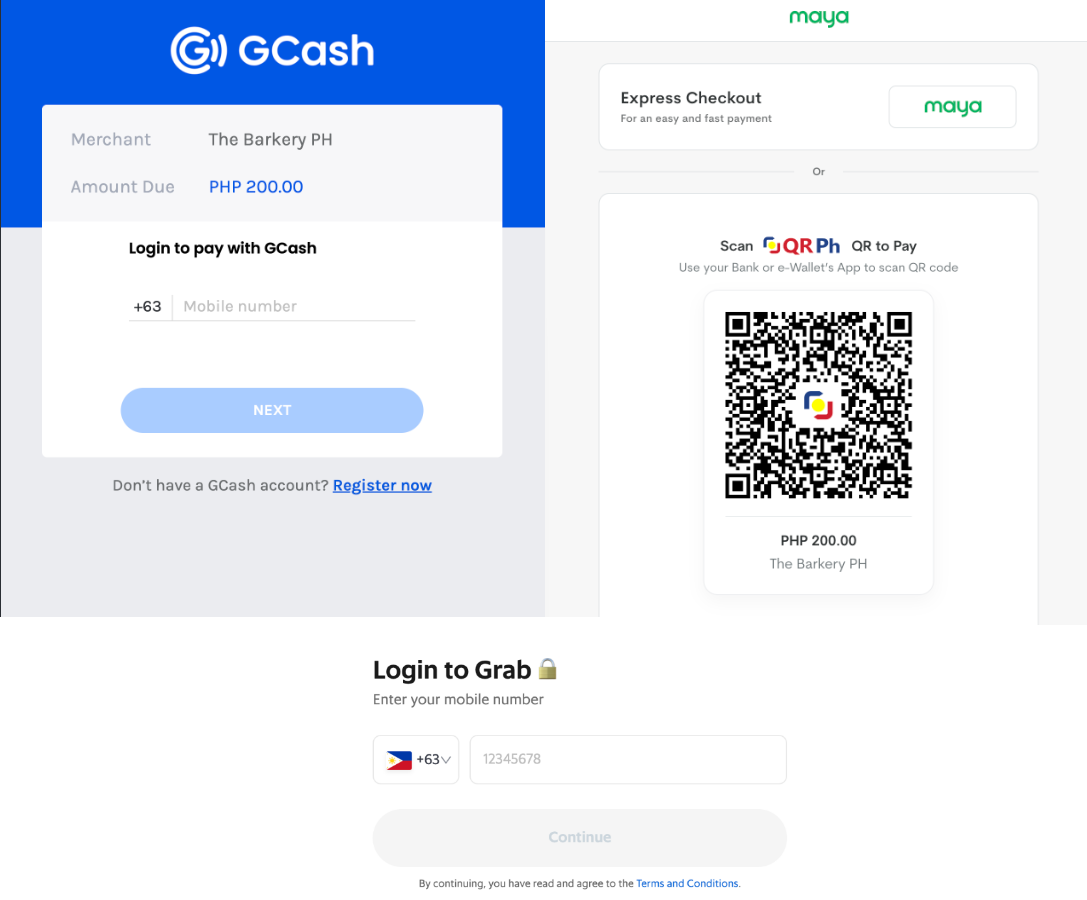

The customer will then be prompted to input his/her billing details.

-

Once done, the customer will then be redirected to the e-wallet's log-in page. The customer would then be prompted to input his/her log-in credentials to the site.

- Once logged in, the customer can proceed to pay using their e-wallet balance. A confirmation message will then appear to notify the customer that the transaction was successful.

Updated 21 days ago